Unions have recently come out in support of progressive tax increases in several states, including New York and Pennsylvania. But while unions like the Pennsylvania State Education Association (PSEA) lobby lawmakers for a more progressive tax structure, the way they collect dues is regressive.

Pennsylvania Gov. Tom Wolf has proposed a $3 billion tax increase that would hit middle class families. His budget, including the tax increase, received some support from Rich Askey, president of the Pennsylvania State Education Association (PSEA) in an email sent to teachers.

“While it is not perfect (no school funding proposal is), the governor’s budget proposal is clearly rooted in the equity and adequacy principles that PSEA has championed for a long time,” he wrote.

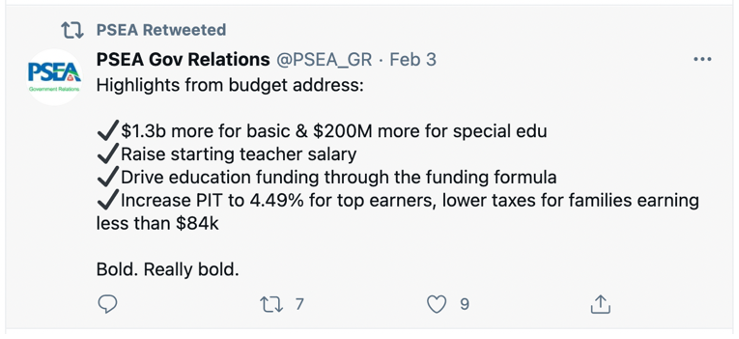

The government relations department for PSEA sent out a tweet with checkmarks next to the governor’s proposals, including a checkmark next to: “Increase PIT (personal income tax) to 4.49% for top earners, lower taxes for families earning less than $84k. Bold. Really bold.”

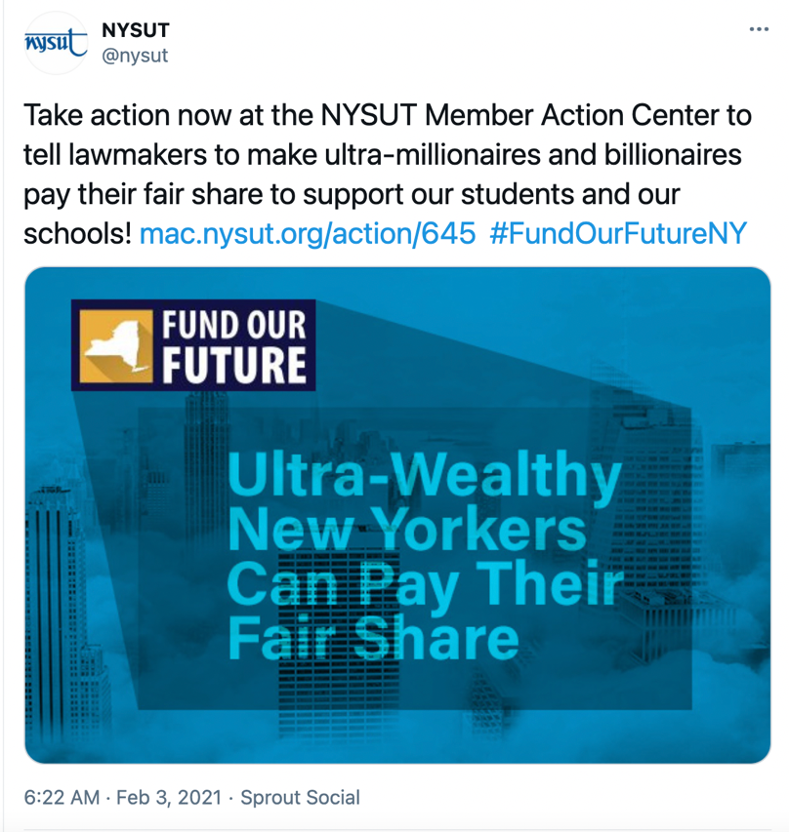

In New York, the New York State United Teachers (NYSUT) launched ads to support Gov. Andrew Cuomo’s plan to raise income taxes on the wealthiest residents, which would increase the top New York City and state combined rate to 14.7%, the highest in the nation.

But both the PSEA and NYSUT don’t expect higher-earning members to pay a higher percentage of their salaries toward the unions.

In Pennsylvania, full-time teachers will pay $553 to the state union during the 2020-2021 school year, on top of dues paid to local unions and the National Education Association (NEA). That amount is the same for teachers in every pay band, so teachers who make less money actually pay a higher percentage of their pay to the union.

In New York, the state teachers’ union collects $378 in dues from every full-time member, in addition to dues that go to local unions and the NEA and American Federation of Teachers (AFT), making NYSUT’s dues regressive as well.

Unions in Massachusetts and Connecticut have also demanded tax increases on higher-earning individuals, while charging their members a flat rate. Some unions in Connecticut cap the amount a member has to pay in a given year, which means members who earn more pay less, according to a Yankee Institute research paper that looked at the lack of progressivity in union dues.

The Pioneer Institute in Massachusetts also looked at this phenomenon. Their study found that new teachers had more than double the dues burden than the highest paid teachers, or 140 percent more.

Unions have not openly acknowledged this double standard. Public sector unions in particular have an interest in promoting higher taxes, since growth in the size and cost of government often benefits unions by increasing their membership and revenue.